Forex Expert Advisors (EAs) are pieces of automated software that use an algorithm (a precisely laid down rule or set of rules) built into their code for the sole purpose of executing trades in the foreign exchange market. These EAs are profitable, save time, and lessen workload by using these automated algorithms. With EAs, traders can streamline manual trading techniques and integrate their benefits into a single algorithm.

In this article, we are going to guide you in choosing the right Forex Expert Advisor to aid your Forex strategy for your trade in the foreign exchange market. Yet it is also advisable to check or backtest your EAs regularly to maximize your profits. But first, let’s give you a basic understanding of EAs and how they work.

What is a Forex Expert Advisor?

Advantages of Forex Expert Advisors

- It saves time and it’s automated: With EAs, traders don’t waste their time looking for indications because the EA takes care of that. The trader just sits and watches the trade as the EA executes the trade.

- Decision-making speed: EAs have been frequently used for scalping and high-frequency trading. Traders don’t have the time to analyze every signal throughout the day because of these trading techniques, which suggest short-term trades in the Forex market that last a few minutes. But an EA is an expert here.

- Your emotions are silenced: With Forex Expert Advisors, your psychological variables are suspended, and they cannot affect your judgment. A trader is prone to making choices that go against risk management and common sense when these choices are influenced by psychological factors such as fear, greed, enthusiasm, and despair. An EA silences all of these.

Disadvantages of Forex Expert Advisors

- It disobeys essential elements: Most Forex Expert Advisors don’t take into consideration a significant increase in volatility and trend reversal brought on by the news, and this might bring major loss to the trader in a time when the trader would have made a huge profit from the brief surge.

- EAs lack intuition: A trader can make a proper choice while incurring a risk, unlike a robot that can only trade by a predetermined algorithm.

- Limitations: An EA cannot be used anywhere. It can only be used on the platform it is intended for. EAs built with MQL are meant for MetaTrader, and those built with C# for cTrader.

How to Choose and Configure a Forex Expert Advisor

Consider these:

Let’s now focus on the things you should take into consideration while selecting the top Forex Expert Advisors.

- Cost: It is only paid Forex Expert Advisors that which profit can be guaranteed because it is configured differently from a free version. A paid Forex Expert Advisor will provide individualized assistance from the creator. It is advisable to backtest a free version first before purchasing it.

- Open Source: The only disadvantage is if the source code is not available for editing. If optimization is required, you won’t be able to make changes.

- The underlying concept of operation: You should be aware of the way the algorithm works, be aware of the tools the robot employs, and how it executes trades, because you may not be able to alter it.

- Statistics are available: Always remember that. You can access statistics on the internet anytime. And using your live account, you can backtest your EA. It will also seem more sensible to manually recalculate some backtest numbers because developers might use them to increase sales.

- Potential profitability: Proclamations of great profitability may be a marketing ploy.

- Reviews: You should be able to distinguish between genuine reviews and ones created for promotional purposes.

- Customer Service: This is where you have a chance to ask developers questions and receive suggestions.

Configuration:

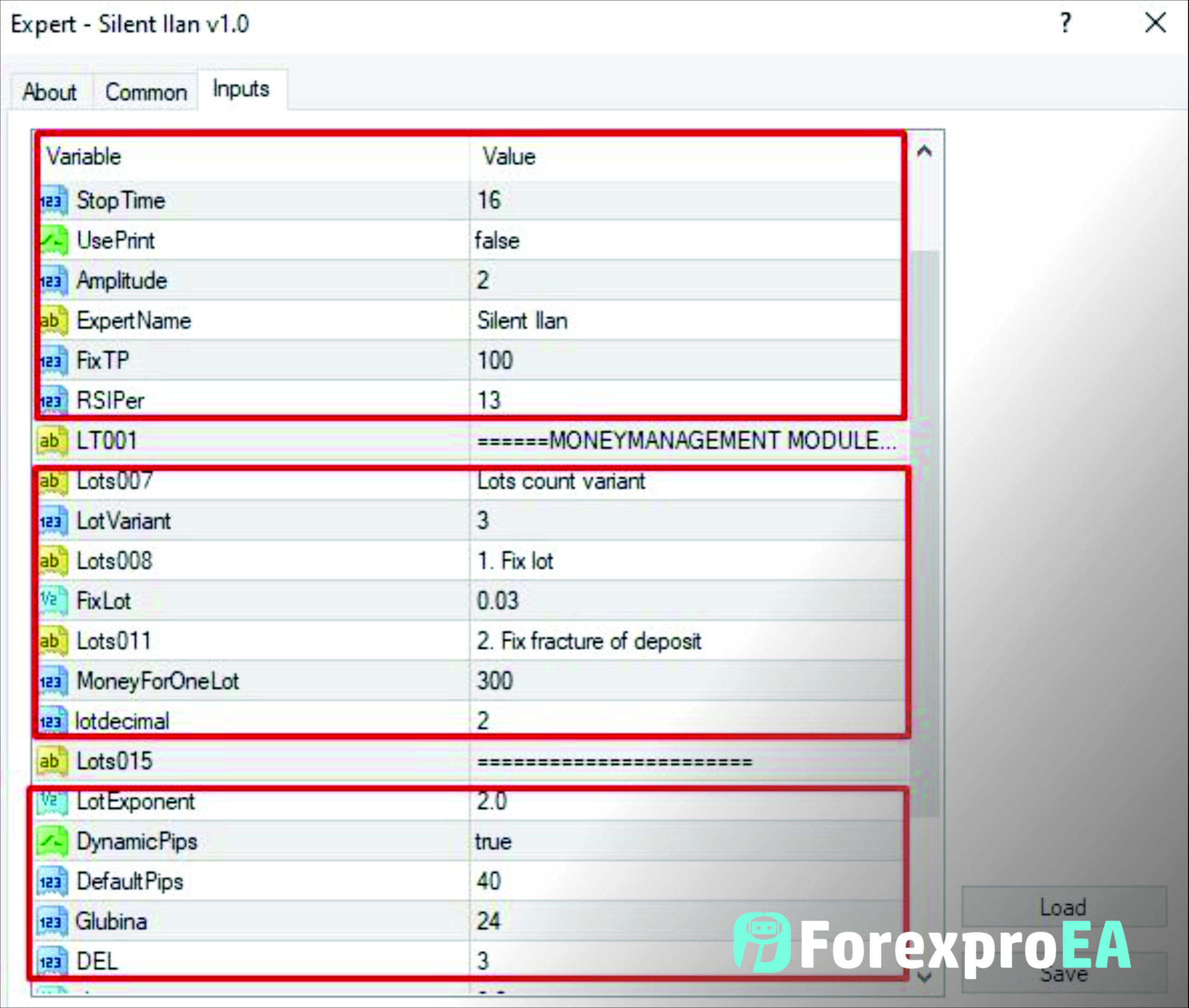

Each automated trading system has its own configuration. There could be anywhere from ten to fifteen to several dozen alternatives. The majority of them fall under one of the following categories:

- Settings for strategy indicators: An Expert Advisor can use different methods that are available to it, and each method has unique indicator parameters, such as time frames and conditions under which the signal appears.

- Settings for managing trade volume: Martingale, hedging, volume growth, and averaging.

- Settings for managing pending orders: Particularly pertinent to grid trading.

- Settings for risk management: Settings for trailing orders and stop-loss. Conditions for both a full and partial withdrawal from the foreign exchange market.

- Additional parameters: Transactions showing up on the chart, the magic number, etc.

A parameter known as the “magic number” enables you to use many Expert Advisors at once. It is used by robots to differentiate their tasks from those made by other robots or by humans.

A simple setting, shown in three blocks: volume control, risk management, and general, is captured in the screenshot above.

A typical Forex trading system comes with a manual containing installation and configuration instructions. All paid Expert Advisors have it, which means you’re going to get one when you purchase an EA. There is an explanation for each parameter in the manual. You’ll also find the best settings for varying risk levels and suggestions. To find the greatest combination of settings for the highest profitability at a manageable level of risk, every Expert Advisor—regardless of the type—is first tested on a demo account.

You may also like Forex Expert Advisors: How to Make the Right Choice in 2025

Best Forex Expert Advisors to Consider

As previously said, Forex Expert Advisors are automated trading programs that use a script to represent a particular algorithm.

The top-performing Forex automated trading advisors are listed here. You will gain a better understanding of their operations and philosophies by reading this review. You will discover how to select an EA based on your personality type, risk tolerance, and trading objectives.

The top Forex expert advisors for automatic trading are contrasted in this table:

1. Forex Diamond EA:

This Expert Advisor has three independent strategies – scalping, trend trading, and counter-trend trading. It is sold for $287 per account license. The potential profit stands at 644% according to the developers.

2. Forex Gump EA:

This is a news filter-equipped scalping advisor that works with 25 currency pairs. It is sold for $199 per account license, and the potential profit stands at 200% per year.

3. Amour EA:

Grid trading EA that operates on the H4 timeframe and maintains open positions for a maximum of three days. Permits averaging but does not employ the Martingale. You can get this EA for free, and the potential profit stands at 15% – 20% per month.

4. Athena EA:

Sold for $793, this grid advisor EA with stock trading experience, appropriate for trading in a flat market with significant volatility, has a potential profit of about 50% per year.

5. Forex Combo EA:

This Expert Advisor opens trades using four different tactics that are trend, counter-trend, range, and scalping. You can purchase it for a discounted price of $167, offering a 50% profit potential.

Frequently Asked Questions

1. How to make the right choice when selecting a Forex Expert Advisor (EA)?

To make the right choice, consider several key factors:

-

Understand the EA’s operating algorithm – Know how it trades, what strategies it uses, and what indicators it relies on.

-

Check for backtest results and statistics – Use verified performance data and run your tests on demo accounts.

-

Evaluate cost vs. value – Paid EAs often offer better support and features, but always test a free version first if available.

-

Read genuine reviews – Be cautious of overly positive, promotional reviews. Look for user feedback that reflects real trading experience.

-

Assess customer support – Good developer support can make a big difference in configuration and troubleshooting.

2. What are 5 ways to make a decision when choosing or configuring an EA?

-

Backtest thoroughly: Use demo accounts to simulate how the EA performs under real market conditions.

-

Compare features: Use a table or checklist to compare EAs based on strategy, timeframe, supported pairs, risk controls, and pricing.

-

Set clear trading goals: Align your EA’s functions with your trading style—whether it’s scalping, grid trading, or long-term strategies.

-

Use verified data and statistics: Don’t rely solely on developer claims—verify profitability through independent or manual calculations.

-

Prioritize risk management: Choose EAs with customizable risk settings like stop-loss, trailing stops, and trade volume controls.

3. How to make decisions for the future when using Forex Expert Advisors?

-

Stay updated with market conditions: EAs don’t adapt intuitively to news or high volatility, so keep monitoring market events.

-

Regularly optimize and update your EA: Use backtesting and forward testing to adapt settings as market conditions change.

-

Diversify your tools: Use multiple EAs with different strategies (using “magic numbers”) to spread risk and enhance adaptability.

-

Invest in learning: Understand the basics of algorithmic trading to better configure and adjust your EAs over time.

-

Plan for scalability: Start small, but choose tools that allow room to grow as your capital and confidence increase.

4. How to make a decision and not regret it when selecting or relying on an EA?

-

Avoid rushing into purchases: Always test before buying, and be cautious of exaggerated profit claims.

-

Base your decision on evidence, not emotion: Just like EAs suppress trading emotions, use data, not hype or fear, as your guide.

-

Understand the limitations: Accept that no EA is perfect—set realistic expectations about profits and risks.

-

Have an exit plan: Know when to pause or switch EAs if performance drops or market conditions shift.

-

Keep control: Use manual oversight periodically to ensure your EA aligns with your broader trading goals.

Conclusion

Forex Expert Advisors have revolutionized the way traders engage with the foreign exchange market, offering speed, efficiency, and emotion-free decision-making. While they present clear advantages—like time-saving automation and consistent execution—it’s important to remember that no EA is a perfect solution. Their limitations, especially the lack of adaptability to sudden market changes or news events, mean they should be used thoughtfully and in conjunction with sound trading practices. Choosing the right EA depends on your trading style, risk appetite, and the level of involvement you wish to maintain. Always backtest thoroughly, understand the strategy behind the software, and ensure you’re using a reliable, well-reviewed EA with adequate customer support. When used wisely, Forex Expert Advisors can be powerful tools that enhance your trading results and simplify your journey in the dynamic world of Forex.