Forex robots are great tools for every Forex trader who wants to trade with little or no involvement. Using automated trading robots using Forex Expert Advisors (EAs) and a reasonably priced VPS can help you make profits with less stress.

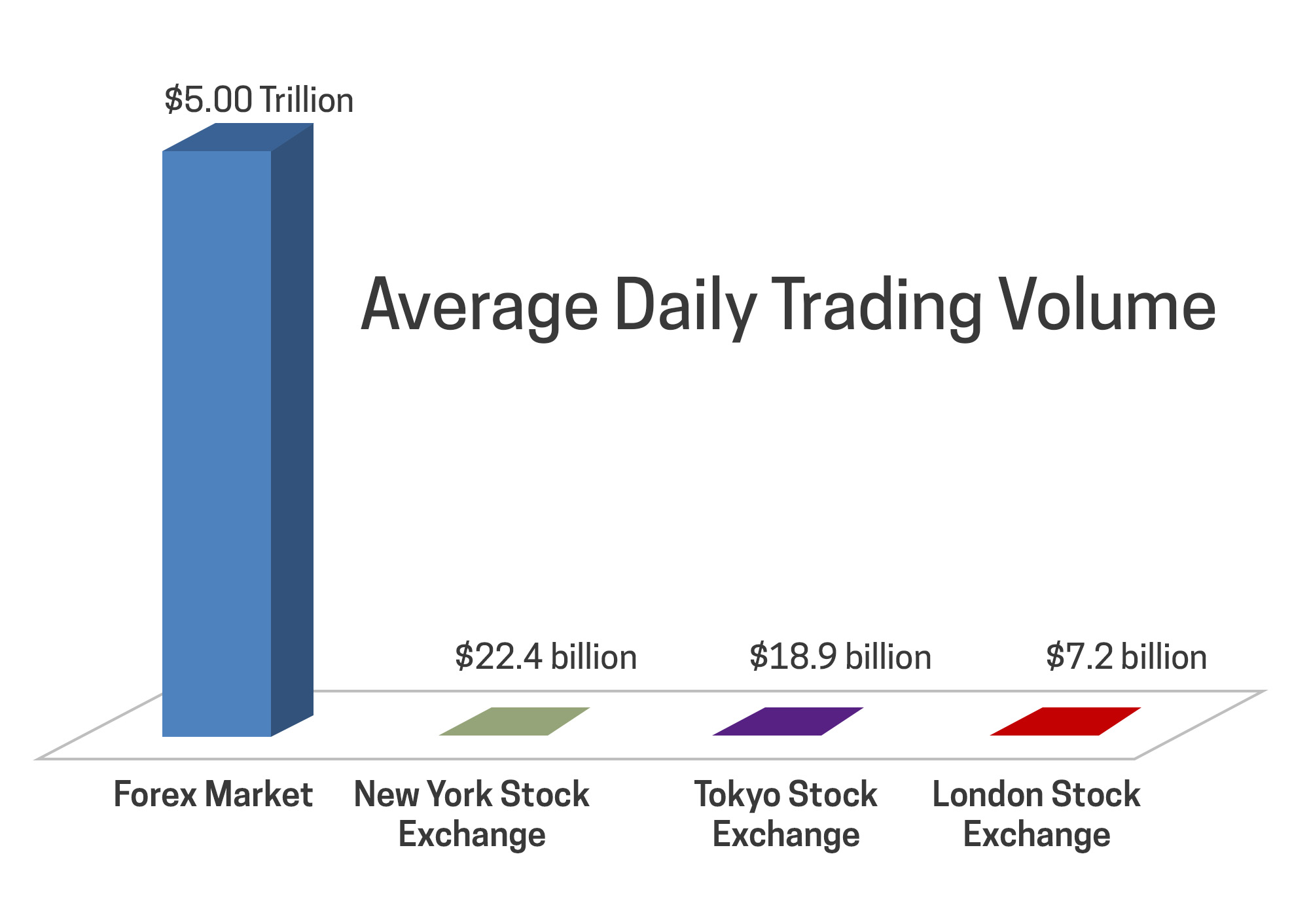

Do you know that the daily trading volume on the Nasdaq is $22.4 billion, whereas the daily trading volume on the FX market exceeds $5.1 trillion? The foreign exchange market dominates every market sector.

Forex trading methods and ecology shifts align with market shifts. Automated trading robots are now very popular, especially because they eliminate human mistakes and emotional swings and allow traders to execute strategies at any time of the day.

Who does the better job – an authentic person or an automated trading robot? The best Forex automated robots are capable of sorting through numerous opportunities, they can assess market circumstances a thousand times faster to select the best one. Unlike human traders, Forex automated robots execute trades without being emotionally attached or affected. You will require a Forex VPS to run your EAs or robots effectively.

However, humans still have something that EAs don’t; humans can act on instinct, which sometimes is more profitable than mathematical algorithms. They can take risks that fit their individual risk tolerance, they can make impromptu judgment and strategy adjustments based on data. Although Forex trading bots are useful tools, each trader still has the last say in the matter.

What do Expert Advisors & Forex Robots mean?

Before we talk about the best performing Expert Advisors or best automated robots, let’s first of all give you a basic understanding of Expert Advisors and Forex Robots – Shall we?

Automated programs or algorithms known as Forex robots examine the Forex markets to identify entry and exit points. These Forex Robots don’t need human involvement because they run on a specific coded algorithm for a set amount of time. They provide trading signals and recommendations that are mostly used on the MetaTrader platform.

Even though they can be automated, some traders only use them to manually test trading opportunities before placing orders.

Traders make profits from EAs and Forex robots basically because they provide methodical, emotionally-neutral, and systematic trading.

You may also like Forex Expert Advisors: How to Make the Right Choice

The Top 10 Performing Robots

Below is a list of the top 10 performing Forex robots. You can choose any one that best suits your trading style and strategies:

- Key Features: High-frequency scalping, low drawdown, safe risk settings

- Strategy Type: Scalping, Trend-following

- Best For: Beginners, Conservative traders

- Price Range: $249.99

- Key Features: Multi-strategy approach, high adaptability

- Strategy Type: Trend-following, Countertrend

- Best For: Experienced traders, Diversified portfolios

- Price Range: $547

- Key Features: Auto-adaptive trading, customizable risk settings

- Strategy Type: Trend-following, Scalping

- Best For: Beginners, Low-risk traders

- Price Range: $149

- Key Features: Automated trend and counter-trend strategy

- Strategy Type: Trend-following, Scalping

- Best For: Traders looking for long-term growth

- Price Range: $467

- Key Features: High-frequency scalping, low drawdown

- Strategy Type: Scalping

- Best For: Advanced traders, Aggressive traders

- Price Range: $297

6. The Trading Agent

- Key Features: Fully automated, robust backtesting and live testing

- Strategy Type: Trend-following, Grid trading

- Best For: Intermediate traders, Systematic trading

- Price Range: Not Available

- Key Features: Low-risk, steady profit, adjustable settings

- Strategy Type: Scalping, Trend-following

- Best For: Low-risk traders, Conservative traders

- Price Range: $539

8. AutoForex Scalper

- Key Features: Aggressive scalping with low-spread optimization

- Strategy Type: Scalping

- Best For: Aggressive traders, Fast market conditions

- Price Range: Not Available

- Key Features: No coding is required, and customizable strategies

- Strategy Type: Any (customizable)

- Best For: Traders wanting flexibility, DIY setup

- Price Range: Free Plan Available

- Key Features: Uses Keltner Channels for entry/exit signals

- Strategy Type: Trend-following, Range trading

- Best For: Traders focused on breakout strategies

- Price Range: Not Available

How do These Forex Robots Work?

Forex robots, or Expert Advisors, are an automated system that uses algorithmic signals to carry out the following tasks:

- Process vast volumes of data: Fundamental analysis is performed by specific, completely programmed robots.

- Trading is automated: Executes trades automatically, doing away with the necessity for human trading.

- Controls major risks: Incorporates risk management tools into its code to take the emotion out of trading.

The coding directs the robot’s actions. The most basic Forex robots allow for many parameters, including establishing stop orders, determining trade volume, and providing warnings for specific market situations. Each block of an advanced Forex robot is in charge of trading methods, including spread control and automatic modifications in response to shifting market conditions. It is essential to comprehend how the Forex bot operates.

Pros and Cons of Expert Advisors and Forex Robots

Pros:

- Automated Trading: Forex robots are automated, which means they can automatically execute trades without your input or influence. This will allow you to focus on other things.

- Accuracy and Speed: It is faster and accurate. This means that it can execute trades faster and more accurately than humans.

- Reduced Emotional Influence: It’s a robot. It can trade without the influence of emotions. Forex robots eliminate the potential for emotional factors to influence poor trading judgments.

- Backtesting: To make sure strategies are good before going live, several EAs allow backtesting on historical data.

- Saves time: Forex Robots research the market and keep an eye on trade signals around the clock.

- Speed and discipline: Human mistakes like hesitancy or emotional decision-making are eliminated by robots.

- Data analysis: To make trade decisions based on statistical probabilities, bots can swiftly collect and evaluate data.

- Other capabilities: Bots can help with human trades by analyzing market trends, spreads, and patterns in addition to trading.

Cons:

- No Profit Guarantee: Although Forex robots can improve accuracy, they are unable to predict unforeseen market occurrences like news or geopolitical developments.

- Over-optimization Risk: Some Forex robots may perform remarkably well during backtesting but poorly during active market situations because they overfit past data.

- Technical malfunctions: Mistakes or missed trades may result from system malfunctions or problems with the internet connection.

Conclusion

Expert Advisors (EAs) and Forex robots have completely changed how traders interact with the Forex market. These technologies provide a more efficient and disciplined way to trade, particularly in a market as large and volatile as Forex, by automating trade execution and eliminating emotional intervention. Even while they have many advantages, such as speed, precision, and ongoing market monitoring, it’s crucial to keep in mind that no system is perfect. Technical difficulties, the possibility of over-optimization, and unforeseen market developments are still significant worries.

In the end, the finest outcomes frequently arise from striking a balance between using human judgment, strategy, and oversight while utilizing the accuracy and consistency of automated Forex robots. Regardless of your level of experience, Forex robots might be a useful addition to your trading arsenal, depending on your trading goals. Make informed decisions, keep an eye on results, and maintain control over your trading process at all times.